Trump’s Tariff-for-Income-Tax Swap

Description from Chicago's Morning Answer:

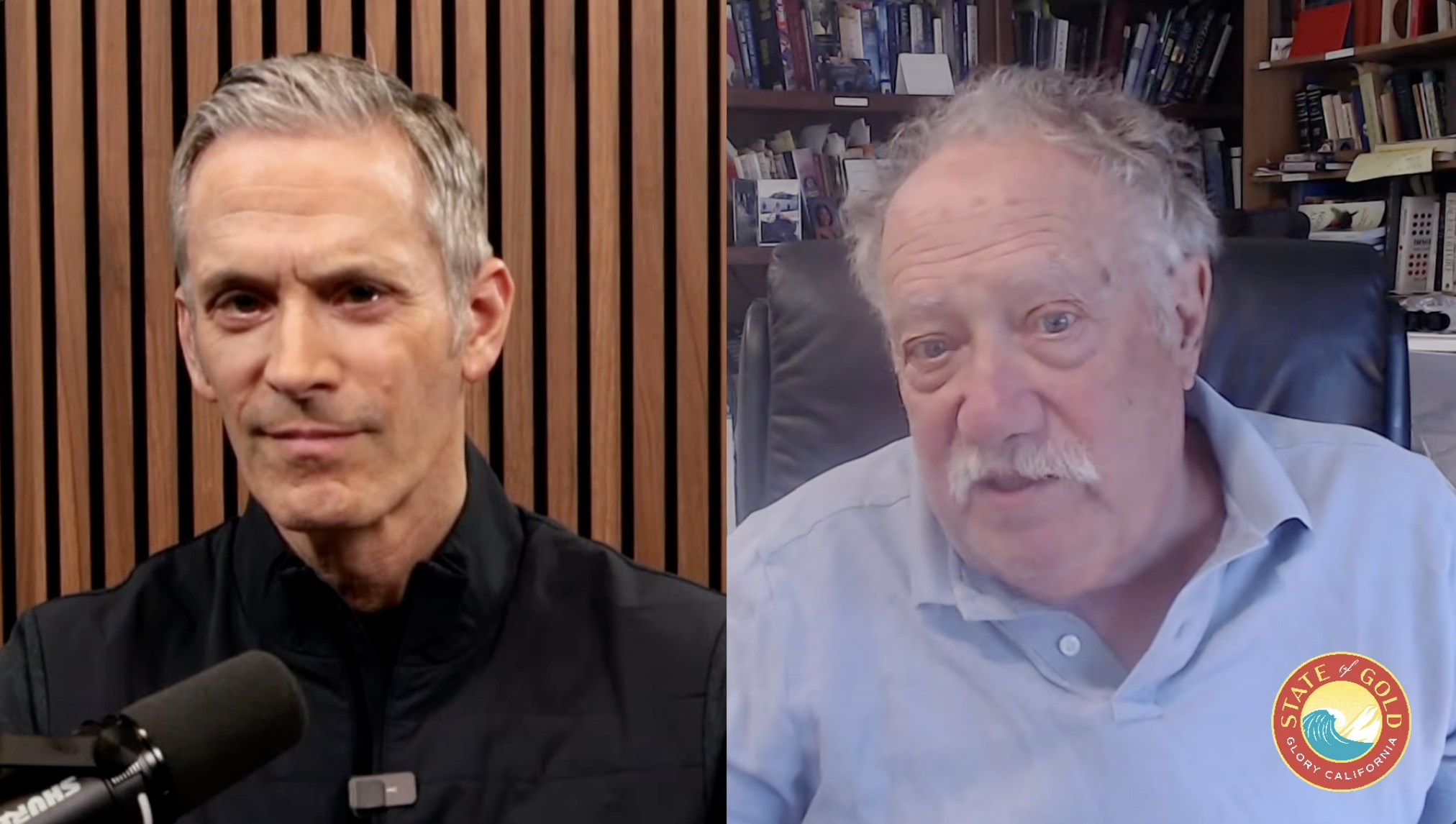

On Chicago’s Morning Answer, host Dan Proft spoke with Richard M. Reinsch, editor-in-chief of Civitas Outlook, about the White House’s new trade framework with the European Union and the broader effects of the Trump administration’s tariff policies.

The agreement, announced this morning, would impose a 15% tariff on most EU exports to the United States—including pharmaceuticals, semiconductors, and lumber—while the EU pledged $600 billion in investments and $750 billion in U.S. energy purchases. Supporters in the administration argue that tariff revenues are so strong they could even eliminate income taxes for Americans earning $150,000 or less.

Reinsch rejected that claim as “almost impossible,” pointing out that tariffs could raise $150–200 billion at best, far short of the $700–800 billion needed to replace those tax revenues. He also noted that consumer behavior changes when tariffs drive up prices, which erodes government revenue over time. Modeling studies project significant price increases in key sectors, such as metals, clothing, and electronics, as the costs work their way down to consumers.

Reinsch cautioned that while allies like the EU and Japan may accept tariffs in the short term, the strategy risks damaging long-term trade relationships and undercutting allies the U.S. needs to counter China. He argued that the administration’s approach contradicts free-market realities, highlighting that the U.S. manufacturing sector remains one of the most productive in the world despite job losses over decades, and that foreign investment and trade deficits are not signs of weakness but reflections of America’s strong capital markets.

The conversation underscored a key debate in U.S. trade policy: whether tariffs truly strengthen domestic industry and national security, or whether they act as a hidden tax on consumers and a drag on global alliances.

Economic Dynamism

.jpg)

Do Dynamic Societies Leave Workers Behind Culturally?

Technological change is undoubtedly raising profound metaphysical questions, and thinking clearly about them may be more consequential than ever.

The War on Disruption

The only way we can challenge stagnation is by attacking the underlying narratives. What today’s societies need is a celebration of messiness.

Unlocking Public Value: A Proposal for AI Opportunity Zones

Governments often regulate AI’s risks without measuring its rewards—AI Opportunity Zones would flip the script by granting public institutions open access to advanced systems in exchange for transparent, real-world testing that proves their value on society’s toughest challenges.

Downtowns are dying, but we know how to save them

Even those who yearn to visit or live in a walkable, dense neighborhood are not going to flock to a place surrounded by a grim urban dystopia.

The Housing Crisis

Soaring housing costs are driving young people towards socialism—only dispersed development and expanded property ownership can preserve liberal democracy.

Oren Cass's Bad Timing

Cass’s critique misses the most telling point about today’s economy: U.S. companies are on top because they consistently outcompete their global rivals.

Blocking AI’s Information Explosion Hurts Everyone

Preventing AI from performing its crucial role of providing information to the public will hinder the lives of those who need it.

.jpeg)

.jpg)